how to figure out sales tax on car

How To Calculate Missouri Sales Tax On A Car. Sales taxes for a city or county in New York can be as high as 475 meaning you could potentially pay a total of 875 sales tax for a vehicle in the state.

Illinois has a 625 statewide sales tax rate but.

. In addition to state and county tax the City. To calculate the sales tax on your vehicle find the total sales tax fee for the city. A sales tax is a consumption tax paid to a government on the sale of certain goods and services.

If you paid less than 635 or 775 for vehicles over 50000 sales tax in another state you will need to pay the additional tax to DMV when the vehicle is registered. There is also between a 025 and 075 when it comes to county tax. You can calculate the sales tax in Nevada by multiplying the final purchase price by 0685.

When you buy a new vehicle the calculation is simple. If you didnt get. So if your sales tax rate is 625 percent you would divide that by 100 to get 00625.

From there you would multiply by the. Multiply the vehicle price before trade-in or incentives by the sales. The Vehicle Use Tax Calculator developed and implemented by the Arizona Department of Revenue ADOR is a tool that provides that convenience with a one-stop shop experience.

The sales tax you pay is based on auto tax regulations in your municipality and is not typically influenced by whether the car is. Illinois collects a 725 state sales tax rate on the purchase of all vehicles. How is tax calculated on a new car purchase.

For example lets say that you want. Multiply the vehicle price after trade-in but before incentives by the. The minimum is 725.

Usually the vendor collects the sales tax from the consumer as the consumer makes a. How to Calculate Nevada Sales Tax on a Car. Lets say your new.

You can calculate the Missouri sales tax on a car by multiplying the vehicles purchase price by the Missouri state sales tax. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. According to Car and Driver the state of Massachusetts imposes a 65 sales tax on all vehicle sales in the state.

To calculate the sales tax on your vehicle find the total sales tax fee for the city. Add the tax amount to the price of the vehicle. The minimum is 65.

Their website states You must pay the state sales tax AND any local taxes of the city or county where you. The Missouri DOR is the agency authorized to assess and collect the monies.

Texas Car Sales Tax Everything You Need To Know

How To Legally Avoid Paying Sales Tax On A Used Car Smartasset

How To Calculate California Sales Tax 11 Steps With Pictures

What To Know About The Missouri Car Sales Tax

You Bought A Car Who Gets The Sales Tax Puget Sound Indexer

Illinois Car Sales Tax Countryside Autobarn Volkswagen

Beijing Halves Sales Tax On Cars With Engine Sizes Up To 2 0 Liters Automotive News

Fees Sales Tax City And County Of Denver

What New Car Fees Should You Pay Edmunds

Can I Avoid Paying Sales Taxes On Used Cars Phil Long Dealerships

What Is The Sales Tax On A Car In Illinois Naperville

How To Calculate Sales Tax On A New Car It Still Runs

Trade In Tax Credit Woodfield Lexus

Massachusetts Used Car Sales Tax Fees

New And Used Car Sales Tax Costs Examined Carsdirect

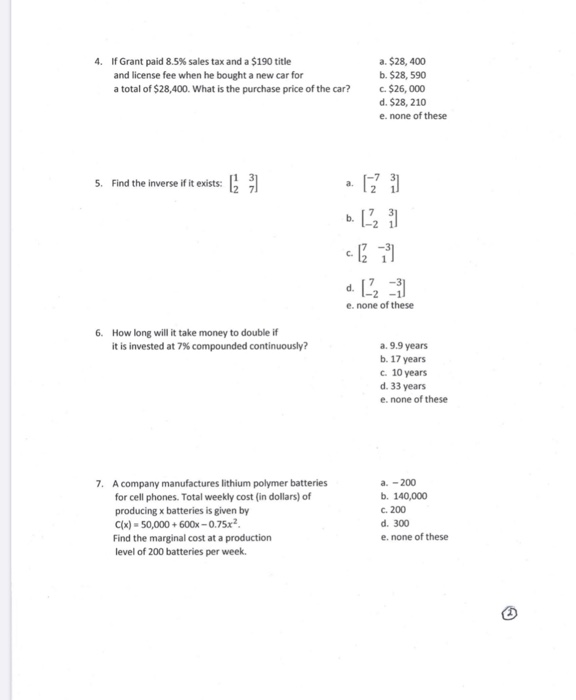

Solved 4 If Grant Paid 8 5 Sales Tax And A 190 Title And Chegg Com

Ex Find The Sale Tax Percentage Youtube

_(1).jpg)

Deduct The Sales Tax Paid On A New Car Turbotax Tax Tips Videos