flow-through entity tax form

For further questions please contact the Business Taxes Division. This legislation was passed as a.

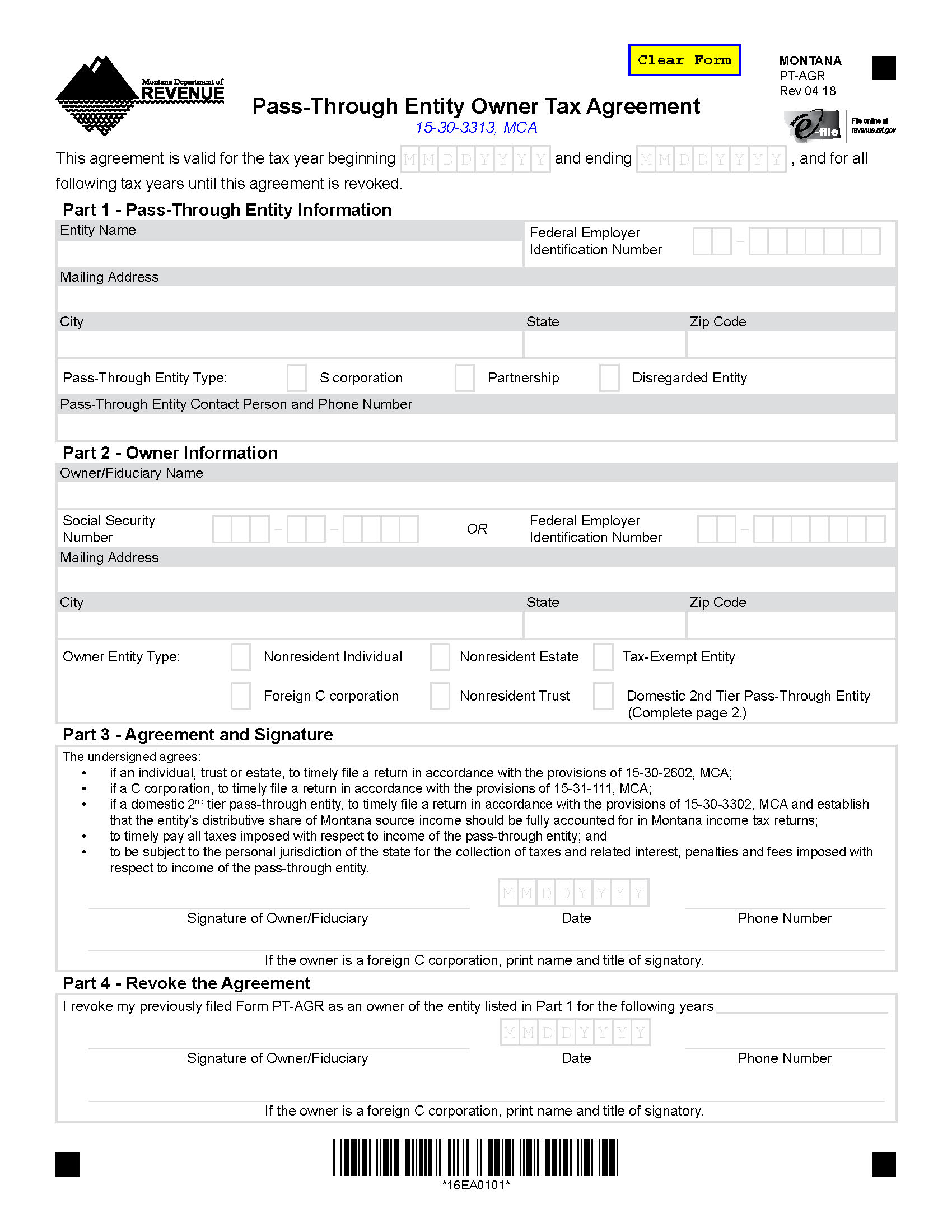

Filing For A Waiver From Pass Through Entity Withholding Montana Department Of Revenue

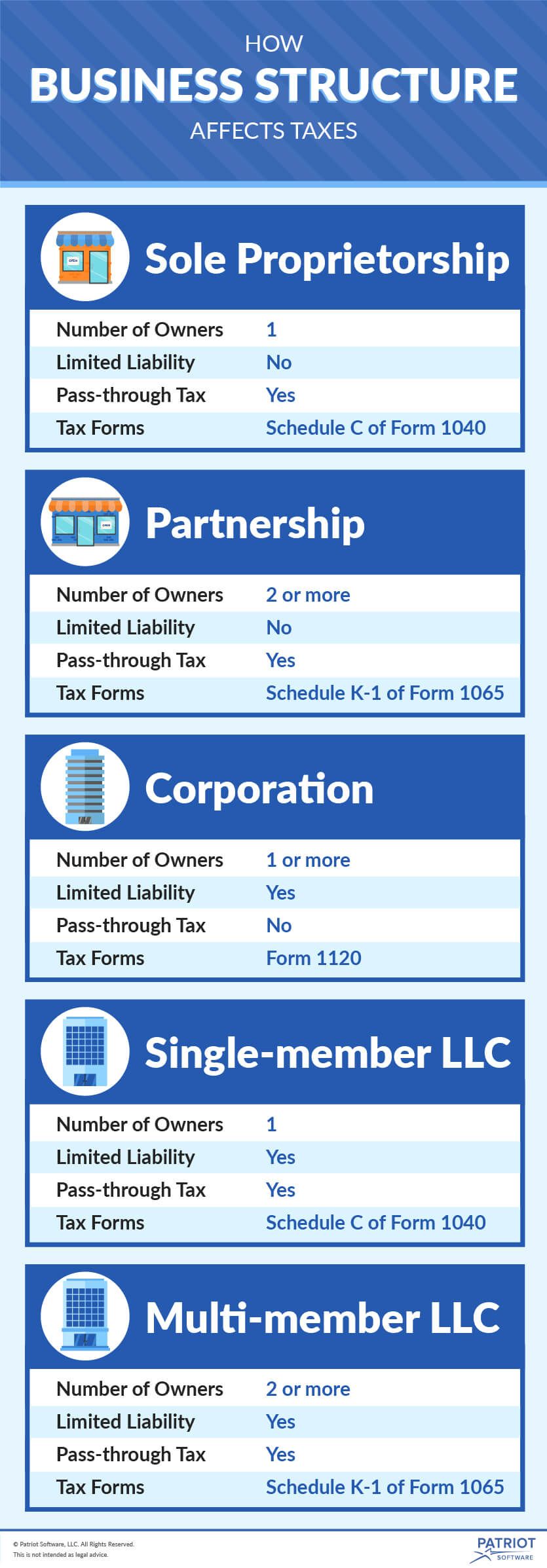

The deduction limits apply both to the business entity and the owner.

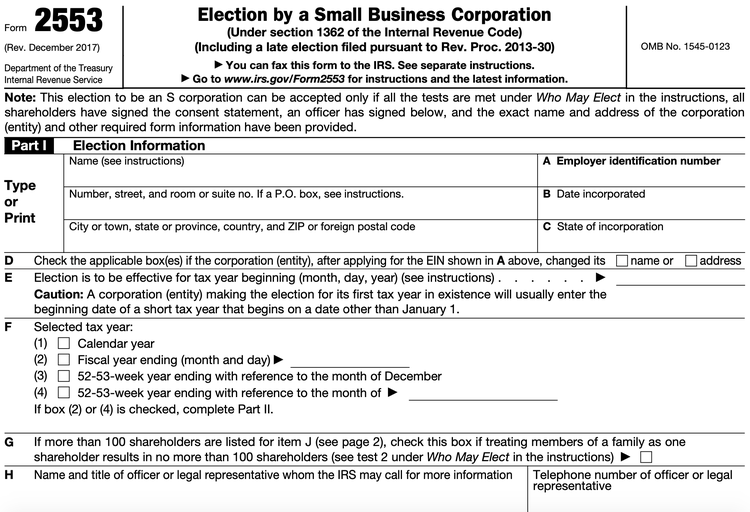

. Governor Whitmer signed HB. 5376 on December 20 2021 enacting a flow-through entity tax for those doing business in Michigan. If you filed Form T664 Election to report a Capital Gain on Property owned at the End of February 22 1994 for any of the above shares of or interest in a flow-through entity.

A QSub like an S corporation is a flow-through entity for federal income tax purposes. Branches for United States Tax Withholding and Reporting. Each entity calculates its 179 expenses and applies the limit.

This section provides information on the types of investments that are considered flow-through entities and how to calculate the capital gain. The following are all pass-through entities. The governor has signed legislation allowing eligible entities to opt in to the New York City pass-through entity tax for 2022.

This optional flow-through entity tax acts as a workaround to the state and local taxes SALT cap which was introduced in the Tax Cuts and Jobs Act of 2017 to limit the. The expenses subject to the limit are then passed. Information about Form W-8 IMY Certificate of Foreign Intermediary Foreign Flow-Through Entity or Certain US.

This guidance is expected to be published in early January 2022 and will be posted to the Departments website. The Michigan Department of Treasury recently issued templates to assist taxpayers with filing their 2021 Michigan Flow-Through Entity FTE Tax Returns. MSC II filed a petition under Chapter 11 of the Bankruptcy Code after which BDI.

A pass-through entity is an entity whose income loss deductions and credits flow through to members for Massachusetts tax purposes. New York City Pass-through Entity Tax.

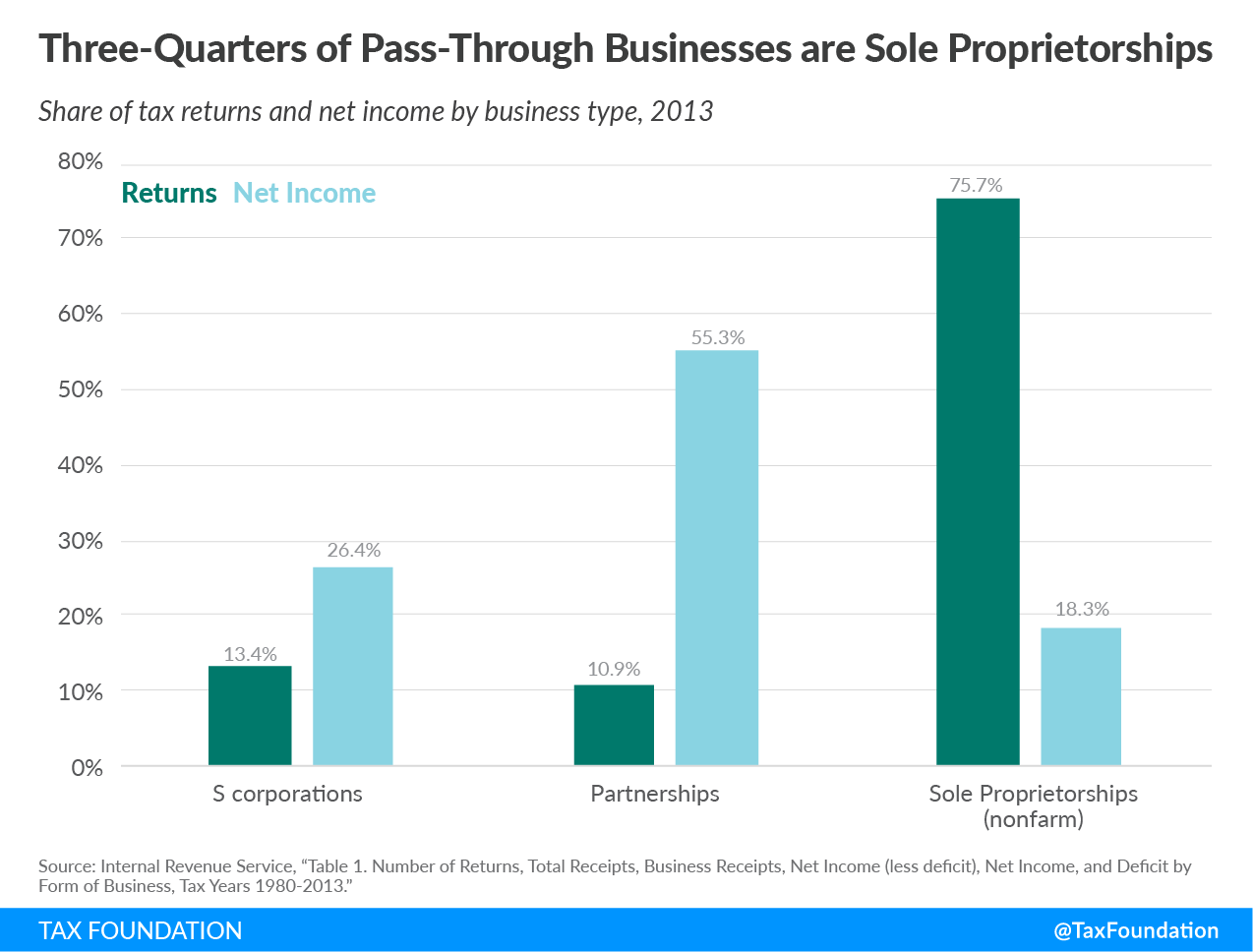

What Are Pass Through Businesses Tax Policy Center

What Are Pass Through Businesses Tax Policy Center

A Beginner S Guide To Pass Through Entities

Oregon Pass Through Entity Elective Tax Kernutt Stokes

Business Entity Tax Basics How Business Structure Affects Taxes

Georgia S Pass Through Entity Tax Election Offers Salt Cap Workaround Mauldin Jenkins

Flow Through Entity Overview Types Advantages

Pass Through Entities Fiduciaries General Information Department Of Taxation

Electing Pass Through Entity It 4738 Department Of Taxation

Maryland Tax For Pass Through Entities The Comptroller Of Maryland

Pw1 Form Fill Out And Sign Printable Pdf Template Signnow

Pass Through Entity Tax Election Changes In Your State Sikich Llp

Tax Guide For Pass Through Entities Mass Gov

Comptroller Extends Filing Deadline For Business Tax Returns Payments Conduit Street

Schedule K 1 Tax Form Here S What You Need To Know Lendingtree

What Are Pass Through Businesses Tax Policy Center

Picpa Committee To Vote On Pass Through Entity Tax House Bill 1709 Wilke Associates Cpas

What Is A Pass Through Business How Is It Taxed Tax Foundation